5/28/2009 5:03 PM

Markets don’t go straight down. Today’s market paused and consolidated the two previous day’s heavy selling. It will be easy for the market to trade in either direction tomorrow. I see the market as a trading range tomorrow and can trade at support and resistance with indications that the buying/selling is drying up. The longer term trade is still a short.

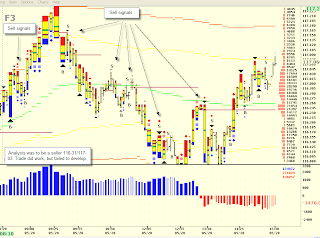

F2 Comments: Buyers entered the market in the OVN session and supported the ZB at 116-00±. The 7Y Note auction was worse than the 5Y auction, but the Dealer community was newly short 163K over the last two days and covering shorts is an easy way to support prices in the cash markets. This buying was present into the close too. If the market can take out 117-20/24 and then hold that level, it can trade higher off of EOW/EOM profit taking. Some news to impact tomorrow’s trading: GDP is expected at -5.5%; Deflator at 2.9%, Chicago PMI at 42.0, Michigan Sentiment at 68.0. Can sell failure at 117-24/118-00. Or buy with signs of support at 116-12/20.